Silver News

Silver Industrial Demand Hits Record High: What It Means for 2024 and Beyond

The global demand for silver is booming — not from jewelry or investment alone, but from industries that are shaping the future. In 2023, industrial demand for silver reached a historic high of 654.4 million ounces, an 11% increase over 2022. This trend isn’t slowing down. From renewable energy to electronics, silver is now a critical metal powering modern technology.

Why Industrial Demand for Silver Is Rising

Silver’s unique properties — high conductivity, reflectivity, and antibacterial qualities — make it indispensable in various industries. But three key sectors are leading the charge:

1. Electronics and Electrical Applications

Silver demand in electronics rose 20% in 2023, reaching 445.1 million ounces. From smartphones and EVs to 5G devices and circuit boards, silver’s superior conductivity makes it essential for efficient, high-performance products.

2. Solar Energy (Photovoltaics)

The solar industry’s hunger for silver grew an astonishing 64%, hitting 193.5 million ounces in 2023. This growth was driven by global adoption of next-gen solar cells and record-breaking solar panel installations — especially in China, which accounted for over 90% of global PV shipments.

3. Green Technology

As the world accelerates toward net-zero emissions, silver is becoming the metal of choice in clean energy infrastructure, EV charging systems, battery technologies, and more.

2024 Forecast: More Growth Ahead

According to the Silver Institute, industrial silver demand is expected to grow another 9% in 2024, setting a new all-time high. The photovoltaic sector alone may rise 20%, reflecting the ongoing global transition to renewable energy sources.

While demand surges, silver supply is projected to decline by 1%, leading to a market deficit of over 215 million ounces — the second-largest shortfall in over 20 years.

What This Means for Silver Prices and Investors

With rising demand and tightening supply, silver prices are climbing. In early 2024, silver gained 30% year-to-date. For investors, this trend suggests strong upside potential.

Options to gain exposure include:

-

Physical silver bars and coins

-

ETFs like iShares Silver Trust (SLV)

-

Silver mining stocks

-

silver industrial demand image

Final Thoughts

The world’s growing reliance on silver in industrial applications, especially green energy and technology, is reshaping the silver market. For manufacturers, investors, and traders alike, understanding this shift is key to staying ahead.

Stay updated with the latest in silver trends and market insights right here on CofeSIlver.

Silver’s industrial demand has been experiencing significant growth, driven primarily by the global push towards green technologies and renewable energy

Record-Breaking Industrial Demand

In 2023, silver’s industrial demand reached a historic high of 654.4 million ounces, marking an 11% increase from the previous year. This surge was largely attributed to the electrical and electronics sector, which grew by 20% to 445.1 million ounces. Notably, the photovoltaic (PV) industry saw silver usage rise by 64%, reaching 193.5 million ounces, due to higher-than-expected capacity additions and the adoption of new-generation solar cells

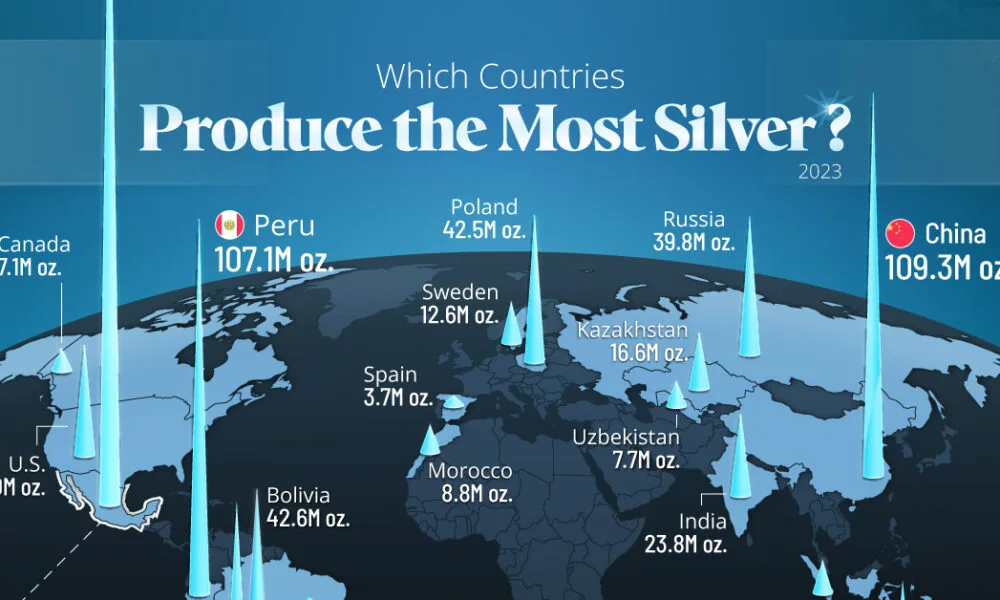

China played a pivotal role in this growth, with its industrial silver demand soaring by 44% to 261.2 million ounces, primarily driven by the expansion of green applications, especially PV. China’s rapid expansion of PV production accounted for over 90% of global panel shipments in 2023

Outlook for 2024

The trend of increasing industrial demand is expected to continue into 2024. Forecasts suggest a 9% rise in industrial fabrication, potentially reaching a new record high. This growth is anticipated to be propelled by a 20% gain in the PV market and robust demand from other industrial sectors

Overall, global silver demand is projected to rise by 1% in 2024, reaching 1.21 billion ounces. However, with total silver supply expected to decrease modestly by 1%, the market is likely to experience another significant deficit, estimated at 215.3 million ounces—the second-largest in over two decades

Investment Considerations

Given the strong industrial demand and supply constraints, silver prices have been on an upward trajectory. As of April 2024, silver prices had increased by 30% since the beginning of the year

Investors interested in capitalizing on this trend might consider the following silver-related financial instruments:

+$1.42(+4.73%)Today

🔑 Primary Keywords

-

silver industrial demand

-

industrial use of silver

-

silver demand 2024

-

silver market trends

-

silver supply and demand

🧱 Secondary Keywords

-

photovoltaic silver demand

-

silver in electronics

-

silver in solar panels

-

global silver shortage

-

renewable energy silver usage

🧩 Long-Tail Keywords

-

how silver is used in green energy

-

why silver demand is rising in 2024

-

silver demand growth from solar industry

-

silver price forecast based on industrial demand

-

impact of technology on silver consumption